Investing in a mutual fund can be one of the most practical ways to enter the world of finance without needing advanced knowledge of the stock market. For beginners, mutual funds provide a gateway to long-term wealth building through professional management and diversification. At the same time, understanding how mutual funds relate to the stock market is essential for making informed decisions.

This will share reliable investment tips for those starting out with mutual funds. Whether your goal is capital growth or financial stability, the right approach to mutual fund investing can align your strategy with long-term stock market trends.

What Is a Mutual Fund?

A mutual fund is a professionally managed investment product that pools money from multiple individuals to invest in a range of financial instruments. These can include shares, debt instruments, or a combination of both. The purpose of a mutual fund is to allow investors exposure to various assets without managing each investment individually.

For beginners, mutual funds serve as an easy entry into the financial ecosystem, particularly the stock market. Rather than choosing individual stocks, an investor relies on the fund’s diversified approach to reduce risk while targeting returns that reflect broader market performance.

How Mutual Funds Connect with the Stock Market

The stock market plays a significant role in determining how a mutual fund performs. Equity mutual funds invest mainly in shares listed on exchanges, and their value changes based on market movement. A rising stock market generally leads to gains in the fund’s value, while a declining market may result in lower returns.

Debt-oriented mutual funds are influenced by interest rates and credit conditions. Meanwhile, hybrid or balanced mutual funds combine both equity and debt exposure to balance the impact of stock market fluctuations. Understanding these connections helps new investors select the type of fund that fits their goals and comfort with risk.

Key Mutual Fund Investment Tips for Beginners

1. Know Your Financial Goals

Before choosing a mutual fund, determine your investment objective. Are you saving for a home, retirement, education, or short-term expenses? The fund you select should align with your expected time horizon and risk tolerance. Long-term goals may favor equity funds, while short-term needs may be better served by debt funds.

2. Understand Risk and Return

Every mutual fund comes with a certain level of risk. Funds that invest in the stock market offer higher return potential but also come with market volatility. Debt funds generally offer more stability but with moderate returns. As a beginner, match your fund type with your ability to tolerate market swings.

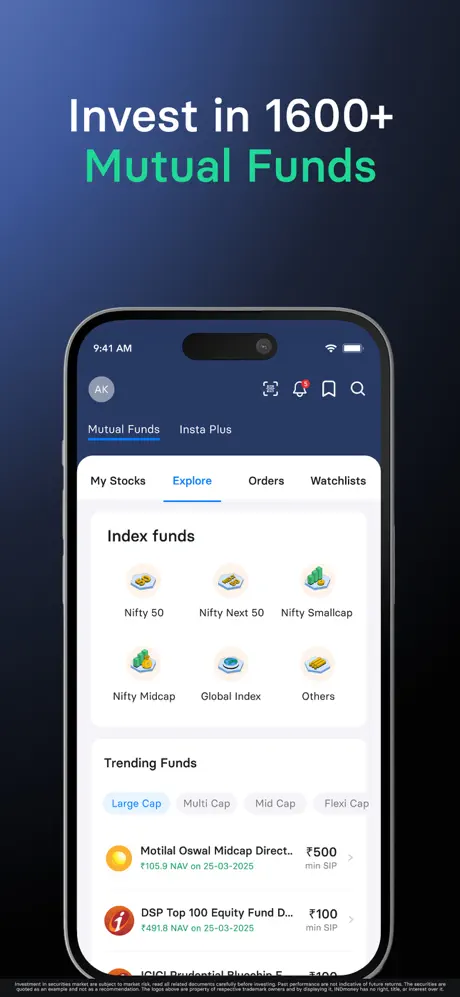

3. Learn About Fund Categories

Mutual funds come in many types, such as equity funds, debt funds, hybrid funds, and index funds. Equity funds focus on company shares, while debt funds invest in fixed-income securities. A balanced approach using hybrid funds can provide a good mix of both for new investors.

4. Choose a Suitable Investment Method

You can invest in mutual funds either as a lump sum or through a systematic investment plan (SIP). For beginners, SIPs are recommended since they allow regular contributions over time. This helps reduce the impact of market volatility and encourages disciplined investing.

5. Track Stock Market Trends

Even though mutual funds are managed by professionals, it’s wise to be aware of general stock market movements. This doesn’t mean checking daily fluctuations, but understanding how global events, economic policies, or inflation rates can influence mutual fund performance helps manage expectations.

6. Read the Fund Factsheet Carefully

Each mutual fund has a factsheet or document that outlines its objectives, asset allocation, past performance, and risk level. Take time to read this document. It gives you a clear idea of how the fund behaves under different stock market conditions and helps avoid surprises later.

7. Keep Costs in Check

Mutual funds come with costs such as expense ratios and exit loads. These charges reduce your overall returns. While it’s important not to make decisions based on cost alone, choosing funds with reasonable fees ensures more of your investment goes toward generating returns.

8. Review and Rebalance Periodically

Once you start investing, don’t set it aside indefinitely. Over time, your financial situation, goals, or risk tolerance may change. Reviewing your mutual fund portfolio periodically ensures that it stays aligned with your objectives. Rebalancing may be necessary to maintain your intended asset allocation.

9. Avoid Timing the Market

Trying to buy at the lowest point and sell at the peak is nearly impossible, especially for beginners. Mutual funds work best with consistent investment over time, regardless of short-term stock market ups and downs. Focus on staying invested rather than reacting to daily price movements.

10. Be Patient with Your Investments

Mutual fund investing is a long-term journey. Don’t expect immediate returns. Some funds may show short-term volatility due to stock market cycles, but with time, many recover and grow. Patience is key to seeing the benefits of compound growth.

Mutual Funds as a Long-Term Strategy

Mutual funds are not about chasing quick profits; they are designed to build wealth gradually. Their association with the stock market allows investors to benefit from market growth without having to research or manage individual stocks.

For beginners, the appeal lies in the balance between risk and reward. With professional fund management, diversification, and options suited to different risk levels, mutual funds offer a structured way to access the stock market’s potential. The key lies in choosing wisely, investing regularly, and staying focused on long-term goals.

Common Mistakes Beginners Should Avoid

- Investing Without a Goal: Without a clear financial purpose, it’s hard to select the right mutual fund.

- Following Market Hype: Avoid choosing a fund just because it’s currently trending in the market.

- Ignoring Risk Levels: Selecting a fund beyond your risk tolerance can lead to panic during downturns.

- Not Staying Consistent: Missing SIP contributions or frequently switching funds reduces the benefits of compounding.

Conclusion

Starting a mutual fund investment journey can seem complex, but with the right approach, it becomes a practical and rewarding experience. For beginners, understanding how mutual funds interact with the stock market lays the foundation for smart decision-making.

By focusing on your goals, understanding risk, and staying consistent, mutual funds can be a reliable component of your financial planning. The stock market may fluctuate, but with disciplined investing and patience, mutual funds can help you build wealth steadily over time.

Mutual fund investing is not about guessing market movements but about creating a structured path toward financial growth. When approached with clarity and care, it becomes one of the most accessible ways to participate in the stock market and reach your long-term objectives.